What Happened to Viasat’s New Satellite?

Losing the massive satellite could rock the satellite internet market

Aug 22, 2024 | Share

News, Technology

The first of Viasat’s trio of ViaSat-3 satellites suffered a catastrophic mechanical failure following its launch, potentially leaving the mission as a total loss. This doesn’t affect current Viasat customers, but it could have a big impact on the entire satellite internet market.

Satellite internet is one of the fastest changing internet markets, with low-Earth orbit (LEO) satellite constellations like Starlink, OneWeb, and Project Kuiper emerging to compete with traditional geosynchronous orbit (GSO) satellites like those used by Viasat and HughesNet. This crisis came at an inopportune time for Viasat as it tried to reaffirm the value of massive GSO satellites. The loss of such a satellite would be a significant financial and technical challenge for the company moving forward and a cautionary tale for other satellite providers.

A small problem on a big satellite

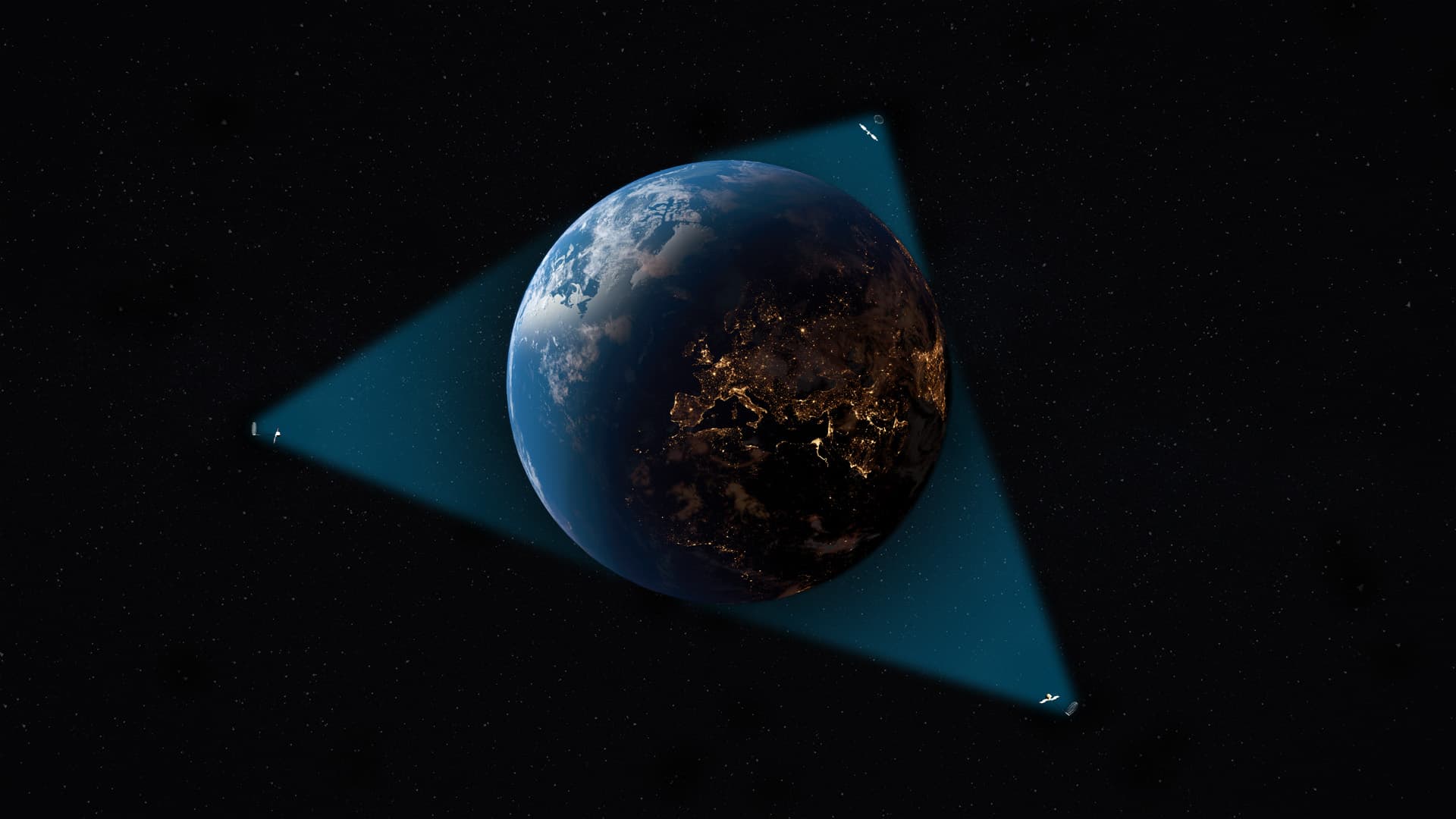

ViaSat-3 is a planned constellation of three GSO satellites: The first was meant to cover the Americas, another to cover Europe, the Middle East, and Africa, and the third to cover Asia and the Pacific. Unlike LEO satellites, which can be around the size of a washing machine, each of the ViaSat-3 satellites is closer in size to a jumbo jet. According to Viasat, ViaSat-3 would be the first terabit-speed broadband satellite system, giving the provider the economy of scale to keep pace with the growing demand and rapid innovation occurring in the satellite internet market.

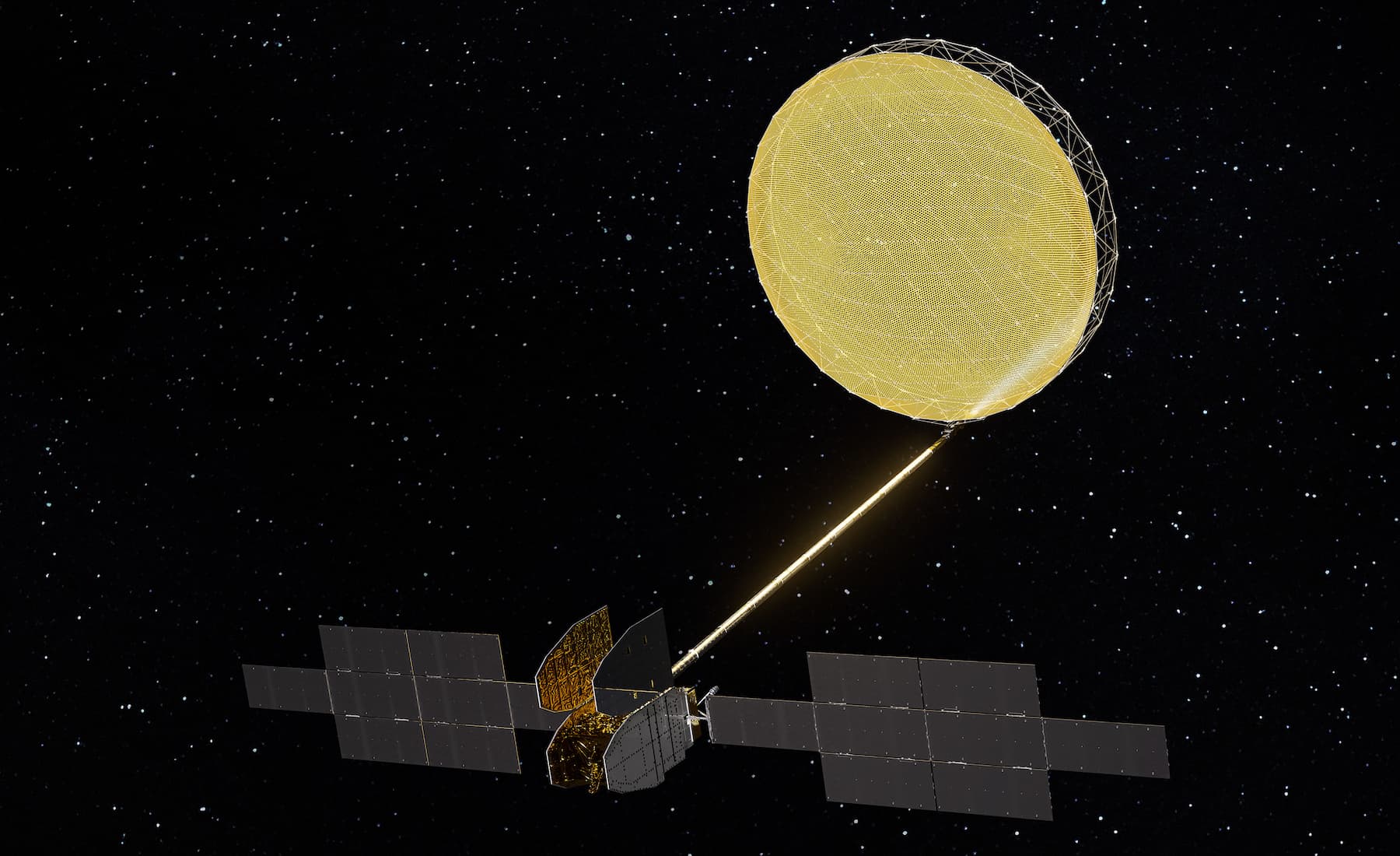

One of the most crucial parts of this new satellite is its large mesh antenna, built by aerospace and defense company Northrop Grumman. This huge parabolic reflector is key to the satellite’s high capacity. A single ViaSat-3 satellite has twice the capacity of all current ViaSat-1 and ViaSat-2 satellites combined. Unfortunately, this antenna malfunctioned as it slowly unfurled after a successful launch.

There are still two more satellites in the ViaSat-3 constellation that have yet to be launched. Only one other satellite, destined for the Europe, Middle East, and Africa area, has an identical reflector to the malfunctioning one on the Americas satellite. The third satellite targeting Asia and the Pacific uses a slightly different antenna. According to SpaceNews, the next ViaSat-3 satellite was originally scheduled to launch in Fall 2023 with the final satellite scheduled to launch six months later. The next satellite is currently scheduled to be launched in mid-to-late 2025.

What does this mean for Viasat customers?

Fortunately for current Viasat customers, this satellite’s failure should have no immediate impact on their service. The malfunctioning satellite’s primary role, according to Justin Bachman at The Messenger, would have been providing mobile internet access to aviation and maritime vessels. While this almost certainly affects Viasat’s long-term strategy, it shouldn’t directly impact residential internet customers, who connect over ViaSat-1 and ViaSat-2 satellites.

The biggest impact for current and potential Viasat customers is that they won’t see the potential improvements the satellite could have provided. The ViaSat-3 constellation was designed to have dynamic bandwidth allocation to move capacity between its beams depending on the demand. This could have improved reliability and consistency for current Viasat customers’ connections and avoided network congestion during peak usage.

What other effects will this malfunction have?

The failure of the ViaSat-3 antenna is a substantial blow to Viasat’s long-term strategy which, according to their 2023 annual report, focuses heavily on prioritizing the growth of mobile services. Other satellite providers like Starlink and OneWeb are also developing mobile internet solutions, so Viasat must now play catch-up in a market they previously hoped to dominate.

While this is a huge financial blow to Viasat, the mission was insured for $420 million. Although this is less than half of the mission’s $700 million price tag, as reported by the San Diego Union-Tribune, it would still be the largest insurance claim ever made for the loss of a satellite if the mission is deemed a total loss. An insurance official quoted in Ars Technica noted that a claim of this size would be disruptive to the space insurance industry and could even trigger underwriters to leave the space market, making future missions even more financially risky.

Regardless of the potential ripple effects in the insurance market, this failure highlights the risks associated with satellite companies putting all their eggs in one basket. Not only are GSO satellites huge, powerful, and expensive—deploying them tens of thousands of miles away from the earth is a massive undertaking. This extreme distance also makes it virtually impossible to mount a repair mission like the one performed on the Hubble Space Telescope in 1993. You’ve only got one shot to get things right, and if you don’t, the satellite is pretty much on its own.

If large GSO satellites start looking like a risky investment, it could push satellite providers further toward the use of LEO satellites, which are smaller, less expensive, and designed to have a much shorter operational lifespan. This puts a lot of pressure on the remaining two ViaSat-3 launches to demonstrate their terabit-speed connections will be enough to justify continuing development of bigger and better GSO satellites in the future.

What will Viasat do next?

A communication satellite without its main antenna sounds about as useful as a car with no wheels, but Viasat’s not giving up on its satellite just yet. Surprisingly, engineers were able to get some data through the satellite in its current state, though it seems that its throughput has been reduced by 90% from its intended 1Tbps speed.

During this time, engineers were collecting data on the satellite’s systems and trying to determine what options they had. An amateur astronomer quoted in Ars Technica noted that the satellite seemed to be regularly changing its orientation, which could have been engineers trying to expand and contract the antenna deployment mechanisms by pointing them toward and away from the sun.

Viasat filed a $421 million insurance claim for the satellite, which helped offset its losses on the project. The company does not currently have plans to build a replacement.

It’s also worth noting that ViaSat-3 is not the only project Viasat has in the works. In May 2023, it completed its acquisition of Inmarsat, a British satellite company working on its own LEO satellite constellation called Orchestra. Inmarsat also operates its own fleet of satellites that focus on providing service to aviation, maritime, and government partners—the same strategic goals that Viasat was targeting with its ViaSat-3 constellation.

The future of Orchestra is somewhat uncertain after Inmarsat’s acquisition, but in any case, Viasat has a lot of options on how to proceed depending on the ultimate fate of the ViaSat-3 Americas satellite.

Layoffs at Viasat

Following the acquisition of Inmarsat, Viasat announced that it would be laying off 800 employees spread across both companies. This represents about 10% of the companies’ combined workforce.

Layoffs are common following large mergers and acquisitions, as many roles will be double-staffed after the two companies are combined, though the move will definitely have a significant impact on the company’s finances. Viasat said that this reduction in its workforce will save $100 million in annual expenses and will “position Viasat for long-term success, while expanding margins and profitability.”

Shifting strategies

Despite the failure of its antenna, Viasat plans to start using the first of its ViaSat-3 satellites to provide internet for in-flight Wi-Fi, albeit at less than 10% of its planned capacity. The second of the three ViaSat-3 satellites will take its place to provide coverage for the Americas, while the first will be moved to cover Europe, the Middle East and Africa.

Despite its high-profile setbacks, Viasat reported record revenues of $4.3 billion for its 2024 fiscal year, fueled in part by its acquisition of Inmarsat, as well as its growth from aviation, maritime and enterprise customers. The company is currently in talks with multiple LEO constellation operators (there’s currently only two, so it’s not much of a secret) to increase its mobile broadband offerings further.

Back from the dead

Despite losing much of its transmission capacity from its malfunctioning antenna and claiming the insurance from the loss of the satellite, in August 2024, Viasat announced that the damaged ViaSat-3 satellite had entered commercial service, offering internet service to aviation customers in North America.

Viasat noted that while the main antenna failed to deploy correctly, the extensive in-orbit testing conducted after the malfunction demonstrated that all other systems on the satellite were operating at or beyond expectations. According to CEO Mark Dankberg, Viasat still expects to get up to 10% of the satellite’s planned capacity, adding that “we may need to make additional investments in ground equipment needed to get to those levels.”

Author - Peter Christiansen

Peter Christiansen writes about telecom policy, communications infrastructure, satellite internet, and rural connectivity for HighSpeedInternet.com. Peter holds a PhD in communication from the University of Utah and has been working in tech for over 15 years as a computer programmer, game developer, filmmaker, and writer. His writing has been praised by outlets like Wired, Digital Humanities Now, and the New Statesman.